Roth conversion tax calculator 2020

Please enter the following information Current age What age do you plan to retire. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Roth Ira Calculator Roth Ira Contribution

Current age 1 to 120 Age when income should start 1 to 120 Number of years to receive income 1 to 30 Before-tax.

. Use the calculator below to examine your own situation. There are many factors to consider including the amount to convert current tax rate and your age. Your income for the tax year will.

This convert IRA to Roth calculator estimates the change in total net worth at. If you know your exact taxable income or just estimate it you can convert only a portion that would not increase your tax rate. The information in this tool includes education to help you determine if converting your.

A conversion has both advantages and disadvantages that should be carefully considered before you make a decision. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will generally pay ordinary income tax on the taxable amount that is converted. 3 Say youre in the 22 tax bracket and convert 20000.

It increases your income and you pay your ordinary tax rate on the conversion. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Convert your Traditional IRA to a Fidelity Roth IRA in just a few easy steps.

This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed. It is mainly intended for use by US. What is your current age.

2022 Roth Conversion Calculator This calculator can help you make informed decisions about performing a Roth conversion in 2022. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. A conversion has advantages and disadvantages that should be carefully considered before a decision is made.

Use the tool to compare estimated taxes when you do. The change in the RMD age requirement from 70½ to 72 only applies to. Youll receive a Form 1099-R with code 2.

Call 866-855-5635 or open a Schwab IRA today. Assume your taxable income is 50000 for 2020. This calculator compares two alternatives with equal out of pocket costs.

Roth IRA Conversion Calculator See whether converting your traditional IRA to a Roth IRA may be beneficial to you. Contributing directly to a Roth IRA is restricted if your income is beyond certain limits but there are no income limits for conversions. Projected tax rate at retirement Assumed.

Tax resources Get up to 20 off 1. Traditional IRA to Roth Conversion Calculator This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is versus converting your. Roth IRA conversion with distributions calculator Use this calculator to see how converting your traditional IRA to a Roth IRA could affect your net worth at retirement.

What is your current plan balance. 16 80 At what. Individuals of all income levels are eligible to convert to a Roth IRA.

Roth IRA Conversion Calculator In 1997 the Roth IRA was introduced. Clicked the drop down arrow to select up to the 22 Tax Bracket Converting up to the 22 bracket my additional Roth conversion for the year is 104050 the projected highest. This calculator can help you decide if converting money from a non-Roth IRA s including a traditional rollover SEP or SIMPLE IRA to a Roth IRA makes sense.

Roth Ira Conversion How To Convert Without Losing Money Or Paying Taxes

Net Worth Tracking Net Worth Calculator Investment Tracker Etsy Video Video Planner Inserts Printable Net Worth Planner Lettering

Form 1040 Income Tax Return Irs Tax Forms Income Tax

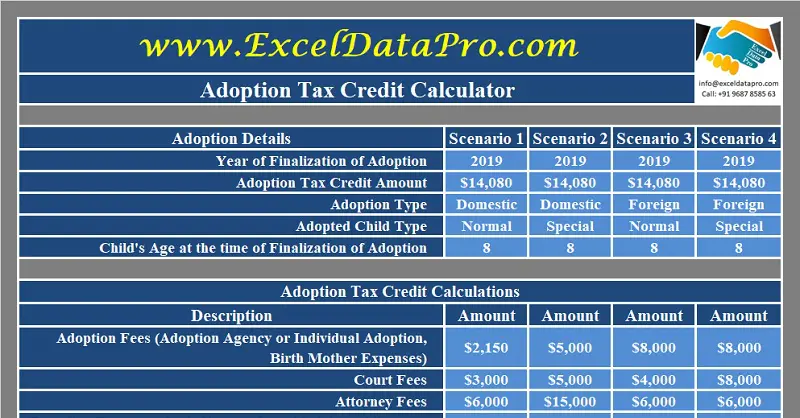

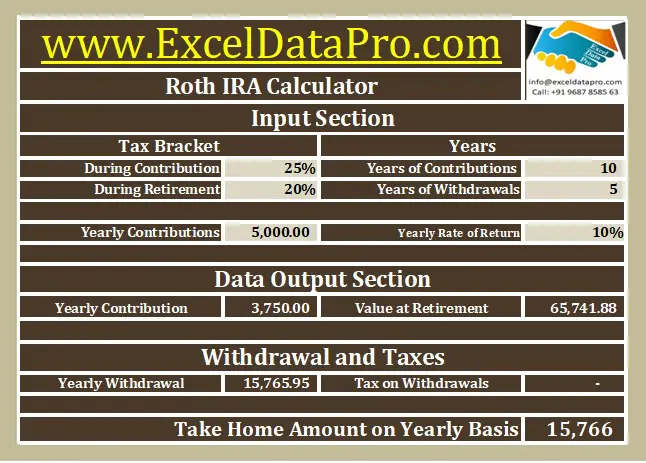

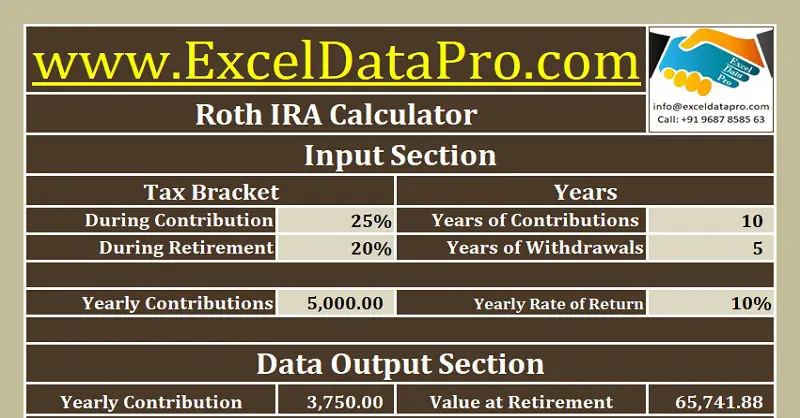

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Traditional Vs Roth Ira Calculator

There S A Big Difference Between A Roth Ira And A Traditional Ira Find Out Which Is Best For Retirement Savings Traditional Ira Roth Ira Ira

Download Roth Ira Calculator Excel Template Exceldatapro

Use My Retirement Calculator To Keep Your Money Away From The Government By Converting Your Ira To A Roth Ira Retirement Watch

Retirement Withdrawal Calculator How Long Will Your Savings Last In Retirement Updated For 2020 Investing For Retirement Personal Finance Lessons Spending Money Wisely

Tax Calculator Estimate Your Income Tax For 2022 Free

Download Roth Ira Calculator Excel Template Exceldatapro

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Income Tax Calculator Estimate Your Federal Tax Rate 2019 20

Roth Conversion Calculator Solo 401k

Roth Conversion Calculator Fidelity Investments